Adding significant value to client relationships

31 August 2018 - Lawtalk

Endowment funds can be established through your local community foundation. They are low cost and low hassle, managing all legal, tax, audit, investment management and governance requirements.

Professional advisers are often surprised to discover how many people get great fulfillment from personal giving. There is no doubt that presenting knowledgeable options on how to give well can be of significant benefit to lawyer-client relationships.

The days of giving to charity by dropping money in a bucket or sponsoring a child are less common. There are many options now that allow people to consider structuring their giving to causes that they care about in a more strategic and fulfilling way. Knowing what these options are can lead to very meaningful lawyer-client conversations.

“Those who work in the law profession are keen to establish long-term relationships with their clients and I have found that a significant way to do this is to have a meaningful conversation about giving or philanthropy,” says Bill Holland, a partner at Holland Beckett Law in Tauranga.

“While most people don’t think of themselves as philanthropists I find that most people do want to make a difference. No client of mine has ever been upset at me suggesting giving as an option, and some are really very thankful for suggestions on how they can structure their giving for the long-term.”

Tony Paine, CEO of Philanthropy New Zealand, says that there are many more options for giving that most people do not consider: “From the obvious small, one-off donations through to purpose-based endowment funds structured for long- term, focused giving.”

Mr Paine says that while many people align philanthropy with the rich and famous, we are seeing in New Zealand more people realising that they can give back to society in a myriad of ways. “Once you know your options, philanthropy really becomes within the reach of almost everyone,” he says.

Conversations on giving are particularly important today as we are poised to see an unprecedented inter-generational wealth transfer from the baby boomer generation about to take place. According to Philanthropy New Zealand the inter-generational wealth transfer in Australia and New Zealand will likely exceed $600 billion over the next 20 years.

“If we can direct even a portion of this towards philanthropy it could change the charity landscape of New Zealand forever,” says Mr Paine. “What a wonderful opportunity this presents to lawyers and financial advisors.”

Why do people give?

For professional advisors it’s helpful to know why people give. Financial advisor Liz Koh says that, to New Zealanders, giving is about much more than technical aspects and tax reduction, it brings a very real level of personal satisfaction.

“I really enjoy talking to my clients about giving. I find most often it’s a warm conversation motivated by their desire to impact the community and their passion for a cause. Many people are also seeking reassurance that their wealth will be used wisely.

“Once they have structured their giving, what they are going to do with their wealth, it can be a real weight off their mind. Often clients gain real fulfillment from it.”

Kirsten Harper, partner in CR Law in Feilding, agrees. “Being in the position to have conversations with clients about social matters and causes, and how they may assist during their lifetimes and after their deaths, is a real privilege. Such conversations go straight to the heart of what clients value as being important to them.”

Bill Holland believes that most people have an innate desire, when their own needs and those of their family are looked after, that they would like to help others. He says this is frequently illustrated when people are asked, what would they do if they won Lotto? “Few people are ever going to win the jackpot, so for most they feel they do not have the opportunity to fulfill their philanthropic desires. Many are delighted to discover that they can.”

He says it can be easy, in the course of a conversation, to see when a client cares deeply about the community in which they live or currently gives to one or more charitable causes.

“They may be interested in creating a personal or family legacy or want to make a difference but aren’t sure where or how to start. They may even be considering a private trust or foundation, but are concerned about cost and complexity … all of these are conversation starters about structuring giving in a more meaningful way.”

The research – why should you even have the philanthropic conversation?

Studies from Canada indicate that 76% of clients agree that discussing philanthropy with their advisor strengthens the relationship.

American research from 2013 has also revealed that such philanthropic conversations would likely improve the client-advisor relationship and strengthen future business opportunities. Further, that high net worth individuals:

- Appreciate and value the advice of their professional advisors in helping them reach their philanthropic aspirations;

- Prefer to discuss their values and passions regarding giving, rather than the technical aspects and tax advantages;

- Would like to have a philanthropic conversation in the beginning stages of their relationship with their professional advisor.

A 2016 UK study (Legacy Giving and Behavioural Insights Report) found that the estate-making process can reliably shape whether people leave assets to charity in their will. Further, if the conversation of giving is normalised as something other people do, it is an easier conversation to have and opens up opportunities.

Yet a 2015 QUT Survey, which highlighted the importance of the professional advisor’s role as a conduit for clients to realise their philanthropic pursuits, found that only one-third of advisors discuss philanthropic issues with their clients, with fewer than three out of five advisors saying they have the skills and knowledge to advise clients about philanthropic issues.

What are the options for giving?

These are many and varied and can include the following:

- Give now, or give later (through a bequest in a will);

- Give small amounts regularly or a lump sum;

- Give directly to a charity or cause;

- Give in perpetuity (forever) to a cause through establishing an endowment fund with the local community foundation;

- Create own trust or foundation, which the donor can manage (with the option to transfer the fund to the local community foundation to manage on the donor’s death).

“Knowing the difference in types of giving can be a real eye-opener for clients. Most are delighted to discover more strategic ways beyond traditional charitable giving,” says Mr Holland.

“For example, establishing an endowment fund is like having your own charitable trust without all the hassle. It enables clients to focus on their giving and the causes that they care about, which is what ultimately want they want to do, and it enables them to give for the long-term.”

What is an endowment fund?

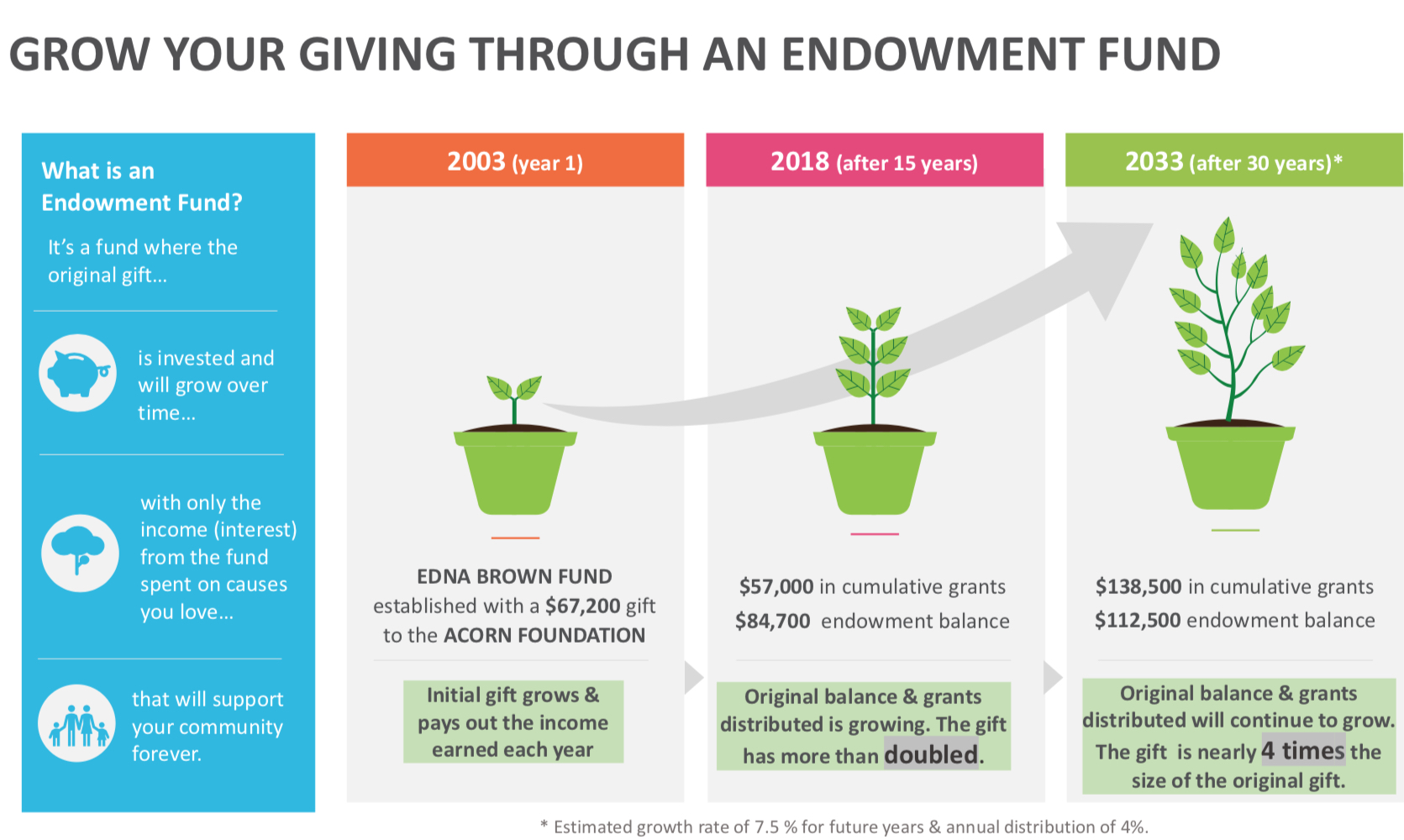

Endowment funds can be established when a client decides to give to a cause for the long-term. Their original gift is not spent, it is invested and the income from the investment goes to the person’s chosen cause forever.

Endowment funds can be established through local Community Foundations (currently 16 in New Zealand). They are low cost and low hassle, managing all legal, tax, audit, investment management and governance requirements.

“Once the fund is set up it’s so easy for the client,” says Bill Holland. “They simply get to decide where the proceeds go. They can choose to give now, and experience the joy of giving while they are alive, or give later through a gift in their will. Both ways I see clients get enormous satisfaction and a real comfort that they are giving well to causes that they care about.”

Liz Koh agrees: “Many people like the way that endowment fund giving is a more strategic way to give, and will benefit their beloved chosen causes forever. In terms of the philanthropic conversation it can be an easier conversation to have too as you are advising on a way to give, not a specific cause; in terms of ethics that is a fine thing to do.”

Eleanor Cater eleanor.cater@xtra.co.nz is a freelance writer and works in the philanthropic sector. She is an elected trustee at the Porirua Community Trust and works for Community Foundations of New Zealand.

Newsletters

- AUTUMN 2024AUTUMN-2024.pdf - (525 KB)

- Summer 2023Summer-2023.pdf - (551 KB)

- Spring 2023Spring-2023.pdf - (515 KB)

- Winter 2023Winter-2023.pdf - (541 KB)

- Autumn 2023Autumn-2023.pdf - (549 KB)

- Summer 2022Summer-2022.pdf - (560 KB)

- SPRING 2022SPRING-2022.pdf - (451 KB)

- Winter 2022Winter-2022.pdf - (1 MB)

- Autumn 2022Autumn-2022.pdf - (460 KB)

- Summer 2021Summer-2021.pdf - (553 KB)

- Spring 2021Spring-2021.pdf - (1.1 MB)

- Winter 2021Winter-2021.pdf - (606 KB)

- Autumn 2021Autumn-2021.pdf - (568 KB)

- Summer 2020Summer-2020.pdf - (584 KB)

- Spring 2020Spring-2020.pdf - (548 KB)

- Winter 2020Winter-2020.pdf - (548 KB)

- Autumn 2020Autumn-2020.pdf - (478 KB)

- Summer 2019Summer-2019.pdf - (1.4 MB)

- Spring 2019Spring-2019.pdf - (493 KB)

- Winter 2019Winter-2019.pdf - (436 KB)

- Autumn 2019Autumn-2019.pdf - (943 KB)

- Summer 2018Summer-2018.pdf - (408 KB)

- Spring 2018Spring-2018.pdf - (349 KB)

- Winter 2018Winter-2018.pdf - (277 KB)

- Autumn 2018Autumn-2018.pdf - (303 KB)

- Summer 2017Summer-2017.pdf - (276 KB)

- Winter 2017Winter-2017.pdf - (1.2 MB)

- Autumn 2017Autumn-2017.pdf - (413 KB)